Guide to Pet Insurance Trials: Protecting Your Furry Friends Without the Cost

Free pet insurance offers can provide pet owners with an opportunity to explore coverage options without any financial commitment. These trials allow pet owners to experience the benefits of insurance, ensuring they can afford necessary veterinary care for their furry companions.

Understanding Pet Insurance

Pet insurance is a financial safety net designed to help pet owners manage the costs associated with veterinary care when their pets become ill or injured. As veterinary bills can be unexpectedly high, pet insurance provides peace of mind, allowing owners to focus on their pet's health rather than financial concerns. This article will explore the fundamentals of pet insurance, including its types, benefits, and key terms that every pet owner should understand.

Why Should You Consider Buying Pet Insurance?

Pet insurance is becoming an increasingly important consideration for pet owners in the U.S. Here are several compelling reasons why purchasing pet insurance is advisable:

Financial Protection

- High Veterinary Costs: The average cost for an accident and illness policy is approximately $676 per year for dogs and $383 for cats. In contrast, emergency veterinary bills can easily exceed $1,500, making insurance a crucial financial safeguard.

- Emergency Situations: Statistics indicate that one in three pets will require emergency treatment each year. Having pet insurance can mitigate the financial burden of unexpected medical expenses, which can range from $3,000 to $7,000 for serious conditions.

Peace of Mind

- Avoiding Tough Decisions: Pet insurance allows owners to focus on their pet's health rather than the cost of treatment. This peace of mind is invaluable when making decisions about necessary medical care.

- Coverage for Unexpected Events: With pet insurance, owners are better prepared for unforeseen circumstances, such as accidents or sudden illnesses, ensuring their pets receive timely care without financial stress.

Increasing Adoption of Pet Insurance

- Growing Market: Over 5.6 million pets were covered by insurance in 2023, reflecting a 17% increase from the previous year. This trend highlights a growing recognition among pet owners of the benefits of having insurance.

will require emergency care each year

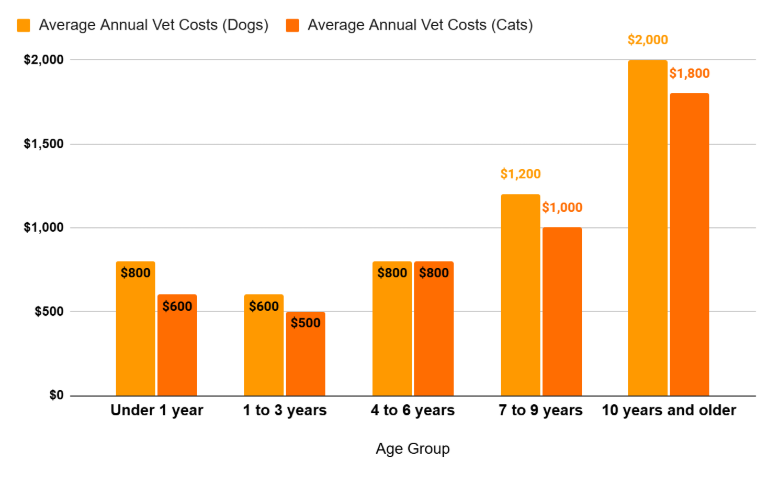

Average Annual Vet Costs for Dogs and Cats

-

Young Pets (Under 1 Year): Young dogs average about $800 annually in veterinary costs, while young cats average around $600.

-

Young Adults (1 to 3 Years): The average annual cost is approximately $600 for dogs and $500 for cats, reflecting stable health during these years.

-

Middle-Aged Pets (4 to 6 Years): Both dogs and cats see similar annual costs of about $800, as health issues may begin to arise.

-

Older Pets (7 to 9 Years): This age group typically experiences more health challenges. The average annual vet costs are around $1,200 for dogs and $1,000 for cats.

-

Senior Pets (10 Years and Older): Senior dogs face the highest medical expenses at about $2,000 annually, while senior cats average around $1,800, highlighting the need for financial preparedness as pets age.

Types of Pet Insurance

Accident-Only Insurance

Description: Accident-only insurance covers injuries resulting from accidents, such as falls, car accidents, or animal bites. It typically has lower premiums but does not cover illnesses or routine care.

- Lower Premiums: Generally more affordable than other types of insurance.

- Simplicity: Easy to understand coverage focused solely on accidents.

- Limited Coverage: Does not cover illnesses, chronic conditions, or preventive care.

- Potential Out-of-Pocket Costs: Pet owners may face significant expenses for non-accident-related health issues.

Illness Insurance

Description: Illness insurance covers a range of illnesses, including infections and chronic diseases. It may include coverage for diagnostic tests and treatments.

- Comprehensive Illness Coverage: Provides financial support for various health issues beyond accidents.

- Diagnostic Tests Included: Often covers necessary tests to identify health problems e\arly.

- Higher Premiums: Generally more expensive than accident-only policies.

- Exclusions and Limitations: May have specific exclusions or waiting periods for certain conditions.

Comprehensive Insurance

Description: Comprehensive insurance combines accident and illness coverage, providing the most extensive protection. It often includes additional benefits like wellness care, dental care, and preventive treatments.

- Broad Coverage: Covers both accidents and illnesses, offering peace of mind.

- Additional Benefits: Often includes preventive care and wellness services that can enhance overall pet health.

- Higher Cost: Typically the most expensive type of pet insurance.

- Complex Policies: Can be complicated with various terms and conditions to understand.

Lifetime Coverage

Description: Lifetime coverage offers continuous coverage for ongoing conditions as long as the policy is renewed. It is particularly beneficial for pets with chronic health issues.

- Continuous Protection: Ensures coverage for chronic conditions throughout a pet's life.

- Stable Premiums: Premiums may remain consistent if the policy is renewed.

- Higher Premiums: Usually comes with significantly higher costs compared to other types of coverage.

- Renewal Requirements: Must maintain the policy without lapses to keep the benefits.

Time-Limited Coverage

Description: Time-limited coverage covers conditions for a specified period (usually 12 months) after diagnosis. After this period, the condition is no longer covered.

- Lower Premiums Compared to Lifetime Plans: More affordable option for those who want some level of illness coverage.

- Defined Coverage Period: Clear limits on how long a condition will be covered.

- Limited Duration of Coverage: Once the time limit expires, no further claims can be made for that condition.

- Potential Gaps in Care: Owners may face challenges if a condition requires long-term treatment beyond the coverage period.

Maximum Benefit Coverage

Description: Maximum benefit coverage provides a maximum payout for each condition per policy year. Once the limit is reached, no further claims can be made for that condition.

- Predictable Costs: Allows pet owners to know their maximum financial exposure for each condition.

- Affordable Premiums Compared to Comprehensive Plans: Generally lower than comprehensive plans while still providing some level of illness coverage.

- Cap on Benefits: Once the maximum is reached, pet owners must pay out-of-pocket for any further treatment related to that condition.

- Limited Scope of Coverage: May not cover all necessary treatments if they exceed the annual limit.

Wellness Plans

Description: Wellness plans focus on preventive care such as vaccinations, routine check-ups, and dental cleanings. They are usually offered as an add-on to other insurance types.

- Preventive Care Focused: Encourages regular veterinary visits and preventive measures to maintain pet health.

- Cost Savings on Routine Care: Can significantly reduce out-of-pocket expenses for routine procedures.

- Not Comprehensive Insurance: Does not cover accidents or illnesses; must be paired with another type of insurance for full protection.

- Additional Cost: Often requires an extra premium on top of existing policies.

Comparison Table of Pet Insurance Types

| Insurance Type | Coverage | Premiums | Best For |

|---|---|---|---|

| Accident-Only | Accidents only | Budget-conscious pet owners | |

| Illness | Illnesses only | Pets with low risk of accidents | |

| Comprehensive | Accidents + illnesses + wellness | Owners seeking full coverage | |

| Lifetime | Ongoing conditions | Pets with chronic health issues | |

| Time-Limited | Conditions limited to 12 months | Owners wanting short-term coverage | |

| Maximum Benefit | Set limit per condition | Owners with specific health concerns | |

| Wellness | Preventive care only | Owners focused on preventive health |

Benefits of Pet Insurance

- Financial Protection: Pet insurance helps mitigate the high costs of veterinary care, making it easier to afford necessary treatments.

- Access to Quality Care: With insurance, pet owners are more likely to seek veterinary care without worrying about the costs involved.

- Customizable Coverage: Many providers allow you to tailor your plan based on your pet's specific needs and your budget.

Key Terms to Know

Understanding common terminology in pet insurance is crucial for making informed decisions:

- Premium: The amount you pay for your insurance policy, typically billed monthly or annually.

- Deductible: The amount you must pay out-of-pocket before your insurance begins to reimburse you for covered expenses. This can be per incident or annual.

- Reimbursement Rate: The percentage of covered expenses that the insurer pays back after you've met your deductible. Common rates are 70%, 80%, or 90%.

- Exclusions: Specific conditions or treatments that are not covered by the policy. Common exclusions include pre-existing conditions and elective procedures like spaying/neutering.

- Waiting Period: The time frame after you purchase a policy during which you cannot claim benefits. This often varies between accident and illness coverage.

- Coverage Limits: The maximum amount an insurer will pay for claims within a specific period (annual limit) or for specific conditions.

How to Buy Pet Insurance

-

Research Insurance Providers: Start by identifying potential insurance companies. You can choose from established national insurers like Nationwide and Progressive or specialized pet insurance companies such as Trupanion and Healthy Paws. Look for companies that operate in your state, as not all providers are available everywhere.

-

Get Multiple Quotes: It's crucial to obtain quotes from at least two or three different insurers. The premiums can vary widely based on your pet's breed, age, and health status. By comparing quotes, you can find a policy that fits your budget while providing adequate coverage.

-

Compare Coverage Benefits: Different policies offer varying levels of coverage. Pay attention to what each plan includes—some may cover only accidents, while others cover both accidents and illnesses. Additionally, examine any exclusions or limitations that may apply to certain conditions.

-

Choose Your Deductible: The deductible is the amount you must pay out-of-pocket before your insurance kicks in. Most insurers offer a range of deductibles, from $100 to $1,000 or more. A higher deductible typically results in lower premiums but may not be beneficial if your pet requires frequent veterinary care.

-

Evaluate Additional Features: Look for policies that offer extra benefits such as wellness coverage, which can help cover routine care like vaccinations and check-ups. Some companies also provide options for multi-pet discounts or bundling with other types of insurance.

-

Enroll with Your Chosen Provider: Once you've selected a policy that meets your needs, complete the enrollment process online or over the phone. Many providers allow you to fill out your pet's profile and submit payment information easily.

-

Consider Free Trials: Many pet insurance companies offer free trials that allow you to test their services without any upfront costs. For example, Trupanion provides a 30-day free trial following a vet exam, while Vetsure offers five weeks of free coverage. These trials can give you valuable insight into how the policy works and whether it suits your needs before making a financial commitment.

Exploring Free Pet Insurance Trials

Pet insurance can be a valuable resource for pet owners, helping to alleviate the financial burden of unexpected veterinary expenses. Many providers now offer free trials, allowing pet owners to experience the benefits of coverage without any initial cost. Here's an overview of some prominent options available in the market.

| Provider | Trial Duration | Coverage | Eligibility | Unique Features |

|---|---|---|---|---|

| Trupanion | 30 days | 90% reimbursement, no waiting period | New pets not previously enrolled | No credit card needed for activation |

| ASPCA | 30 days | Comprehensive coverage | Activate within 3 days of vet visit | No obligation after trial |

| Pawfect | 3 months | Up to 90% reimbursement | Sign up with promo code | Lifetime chronic illness coverage |

| Vetsure | 5 weeks | Accidents and illnesses | New customers | Digital claims processing |

| Petsecure | 6 weeks | Complimentary trials | For adopted pets and puppies/kittens | Tailored programs for different needs |

Trupanion's 30-Day Free Trial

Overview: Trupanion partners with veterinary clinics to provide a 30-day free trial of their pet insurance. This offer allows pet owners to assess whether Trupanion's coverage meets their needs.

Eligibility: Any pet that has not previously participated in a trial can qualify, regardless of their health status at the time of the visit.

How It Works:

- A comprehensive exam is required, after which a trial code is provided.

- No credit card information is needed to activate the trial.

- Coverage includes 90% reimbursement for eligible treatments, minus a deductible, with no waiting periods during the trial period.

- At the end of 30 days, coverage automatically lapses unless the owner chooses to continue with a paid plan.

ASPCA Pet Health Insurance 30-Day Trial

Overview: The ASPCA offers a 30-day trial for its pet health insurance plans, allowing pet owners to explore their options without upfront costs.

Activation: The trial can be activated up to three days after a veterinary visit.

Benefits:

- Comprehensive coverage during the trial period.

- No obligation to continue after the trial ends, providing flexibility for pet owners.

Pawfect Care's 3-Month Free Trial

Overview: Pawfect Care provides an extended offer of three months free pet insurance coverage.

Eligibility and Activation:

- Pet owners must sign up using a specific promo code during the promotional period.

- Coverage includes up to 90% reimbursement for medical expenses without sublimits on individual benefits.

Unique Features:

- Offers lifetime coverage for chronic illnesses if enrolled at a young age.

- No restrictions on breed types, making it inclusive for all pets.

Vetsure's 5 Weeks Free Offer

Overview: Vetsure offers five weeks of free pet insurance, allowing new customers to test their policies.

Features:

- Coverage includes both accident and illness options.

- Customers can adjust their coverage levels according to their needs.

- Claims can be processed digitally for quick reimbursement.

Petsecure's Complimentary Trials

Overview: Petsecure provides various complimentary trials tailored for new pet owners and breeders.

Programs:

- Adoptsecure: A six-week free trial for adopted pets.

- Breedsecure: A six-week trial specifically designed for puppies and kittens from breeders.

How to Activate a Pet Insurance Free Trial

Pet insurance can be a valuable resource for pet owners, offering financial protection against unexpected veterinary expenses. Many providers now offer free trials, allowing you to experience coverage without any upfront costs. This guide will walk you through the steps to activate a pet insurance free trial effectively.

Step 1: Research Available Free Trials

Before you can activate a free trial, it's essential to know which pet insurance companies offer them. Some popular options include:

- Trupanion: Offers a 30-day free trial after a veterinary exam.

- Pets Plus Us: Provides a 6-week trial with up to $7,500 in coverage.

- ASPCA Pet Insurance: Allows a 30-day trial that can be activated after a vet visit.

- Pawfect Care: Features a 3-month free trial of coverage.

Make sure to check the eligibility requirements and specific details of each offer.

Step 2: Schedule a Veterinary Exam

Most free trials require an initial veterinary exam to assess your pet's health. This step is crucial as it ensures your pet is eligible for coverage. When scheduling the appointment, confirm with the clinic that they participate in the free trial program you are interested in.

Step 3: Complete the Exam

During the veterinary visit, your pet will undergo a comprehensive health evaluation. After the exam, ask about the next steps for activating the free trial. The veterinarian or staff will provide you with any necessary forms or codes needed for enrollment.

Step 4: Activate Your Free Trial

Once you have completed the vet exam, follow these steps to activate your free trial:

-

Obtain Activation Information: After your appointment, you will typically receive a form or code from the veterinary office. This may include instructions on how to activate your trial online or via phone.

-

Visit the Insurance Provider's Website: Go to the website of the insurance provider offering the free trial (e.g., Trupanion, Pets Plus Us). Look for a section dedicated to promotions or free trials.

-

Fill Out Required Information: Complete any online forms with your personal details and your pet's information. This may include:

-

Your name and contact information

-

Your pet's name, breed, age, and health status

-

Submit Activation Request: Follow through with submitting your activation request as directed. Many providers allow activation within a specific timeframe (usually 24-72 hours) after your vet exam.

-

No Payment Information Required: Most free trials do not require credit card information for activation, ensuring there are no hidden fees or obligations at this stage.

Step 5: Enjoy Your Coverage

Once activated, you can enjoy the benefits of your pet insurance free trial. Coverage typically includes reimbursement for eligible veterinary expenses during the trial period—often up to 90% of costs after deductibles are met.

Important Considerations

- Expiration: Be aware of when your free trial ends. Most trials automatically lapse after their duration unless you choose to continue with paid coverage.

- No Obligation: At the end of the trial period, there is usually no obligation to purchase a policy. You can decide based on your experience during the trial.

- Documentation: Keep track of any communications from the insurance provider regarding your trial status and potential follow-up offers.

Eligibility and specific terms can differ significantly among providers. Some may require a veterinary examination before activating the trial, while others might have age restrictions or limitations on the types of pets covered. Therefore, it is essential to review each provider's policy details carefully before proceeding. Ultimately, the decision to take advantage of a free trial should be based on the specific offerings and guidelines of the pet insurance provider you are considering. This ensures that you fully understand what is included in the trial and how it aligns with your pet's needs.

Pet Insurance Remarks

Purchasing pet insurance is a vital step in ensuring the health and well-being of your furry companions while protecting your finances from unexpected veterinary expenses. By understanding the various types of coverage available and carefully evaluating different providers, you can make an informed decision that best suits your pet's needs. Take advantage of free trials offered by many insurers to explore their services without financial commitment. This allows you to assess the coverage and customer support before making a long-term commitment. Ultimately, investing in pet insurance not only provides peace of mind but also ensures that your beloved pets receive the care they deserve, no matter the circumstances.

-

![]()

Finding the Right Independent Living Apartments: A Tailored Guide for Seniors on a Budget

This guide explores affordable independent living options for seniors, including budget-friendly communities, financial assistance, and resources for those on a fixed income. Financial and Social Ben…

-

![]()

Harnessing Technology for Business Growth: The Essential Tools for Sales, Advertising, and Cloud Management

In an era where technology drives business success, selecting the right tools is crucial. Companies that effectively utilize sales, advertising, and cloud management platforms can significantly enhan…

-

![]()

Affordable Excellence: The Best Unsold SUVs Under $15K for 2025

As the automotive market continues to evolve, with numerous options available for budget-conscious buyers, finding a reliable and affordable SUV can be a daunting task. This year, several unsold SUVs…